Choosing the right Chase credit card lets you turn routine spending into valuable rewards in the United States.

This guide organizes the leading options—cashback, travel, and beginner-friendly—so you can match each feature to your lifestyle, maximize benefits, and avoid hidden costs.

Why Pick a Chase Credit Card?

Leveraging a Chase card positions you for generous bonuses, flexible redemption, and proven security on transactions processed worldwide.

- Robust rewards structure across travel, dining, and everyday categories keeps payoff rates high.

- Global acceptance ensures smooth purchases in nearly every country.

- Premium protections—purchase security, extended warranty, and trip cancellation insurance—reduce risk and out-of-pocket losses.

- User-friendly digital tools simplify account management through the Chase Mobile® app or online dashboard.

Chase Lineup Snapshot

Start by mapping each flagship card to its primary strength. Reviewing this list clarifies which product deserves your application first.

| Card | Core Benefit | Annual Fee | Sign-Up Bonus |

| Freedom Unlimited® | Flat-rate cashback on all spending | $0 | $250 after $500 spend |

| Freedom Flex® | Rotating 5 % categories | $0 | $200 after $500 spend |

| Sapphire Preferred® | High-value travel points | $95 | 100 000 points after $5 000 spend |

| Sapphire Reserve® | Luxury travel perks | $550 | 60 000 points after $5 000 spend |

| Freedom Rise® | Credit-building starter card | $0 | None, ongoing 1.5 % cashback |

| United Explorer | Airline-specific rewards | $0 first year, then $150 | 80 000 bonus miles |

| Prime Visa | Amazon-centric cashback | $0 | $100 Amazon gift card |

| Ink Business Preferred® | Broad business rewards | $95 | 100 000 points after $8 000 spend |

Rates and fees can change at Chase’s discretion. Verify details on the issuer’s website before applying.

Best Chase Cards for Reliable Cashback

Earning uncomplicated cashback boosts savings on global purchases. These cards return value without category micromanagement.

Freedom Unlimited®

You collect competitive returns on every transaction while skipping quarterly activations.

- Cashback Rate: 1.5 % on all spending, plus 3 % on dining and pharmacies, and 5 % on Chase Travel℠ bookings.

- Intro APR: 0 % for 15 months, shifting to 19.99 %–28.74 % variable.

- Annual Fee: $0, keeping net rewards intact.

Freedom Flex®

Rotating categories enable higher seasonal earnings if you track quarterly calendars.

- Cashback Rate: 5 % on activated quarterly categories up to $1 500, 5 % on Chase Travel℠, 3 % on dining and pharmacies, 1 % elsewhere.

- Intro APR: 0 % for 15 months, then 18.99 %–28.49 % variable.

- Annual Fee: $0, ideal for budget-centric users.

Prime Visa

Amazon loyalists recapture significant spend across e-commerce and grocery segments.

- Cashback Rate: 5 % at Amazon, Whole Foods, and Chase Travel℠; 2 % at restaurants, gas, transit; 1 % everywhere else.

- Immediate Bonus: $100 Amazon gift card after approval (Prime membership required).

- Annual Fee: $0.

Select Freedom Unlimited when hands-off earnings appeal to you, Flex when category planning fits your habits, and Prime Visa when Amazon dominates household purchases.

Best Chase Card for Building Credit Responsibly

Beginners usually start their journey in building their credit using this card.

Freedom Rise®

Beginning your credit journey demands a forgiving yet rewarding product. Freedom Rise provides exactly that.

- Cashback Rate: 1.5 % on every purchase, helping offset everyday costs.

- APR: 25.99 % variable—pay balances monthly to avoid high interest.

- Approval Tip: Keep at least $250 in a Chase checking or savings account to strengthen eligibility.

- Annual Fee: $0, preventing unnecessary expenses while the credit history matures.

Best Chase Cards for Travel Rewards

Travel enthusiasts gain outsized value through the Sapphire family and airline co-branded options.

Sapphire Preferred®

Balance robust rewards with a reasonable annual fee.

- Sign-Up Bonus: 100 000 points after $5 000 spent in three months.

- Earning Structure: 5x points on Chase Travel℠, 3x on dining, 2x on other travel, 1x on remaining purchases.

- Point Value: 25 % boost when redeemed through Ultimate Rewards®.

- Annual Fee: $95—a manageable cost for frequent flyers.

Sapphire Reserve®

Frequent global travelers offset the high fee via substantial perks.

- Rewards: 10x on hotels and car rentals, 5x on flights, 3x on dining after an automatic $300 yearly travel credit.

- Airport Comfort: Priority Pass™ lounge access elevates long layovers.

- Annual Fee: $550 plus $75 per authorized user; luxury benefits justify the premium for continuous travelers.

United Explorer

Optimized for travelers loyal to United Airlines.

- Miles: 80 000 bonus miles after qualifying purchases.

- Earnings: 2x on United flights, dining, and hotel stays; 1x elsewhere.

- Perks: First checked bag free and priority boarding reduce out-of-pocket fees.

- Annual Fee: Waived year one, $150 after.

Business Owners: Ink Business Preferred®

Generating points on operational costs accelerates reward accumulation for companies trading worldwide.

- Bonus: 100 000 points after spending $8 000 within three months.

- Category Multiplier: 3x points on travel, shipping, internet, cable, and social media advertising, up to $150 000 per anniversary year.

- Annual Fee: $95, easily covered by everyday business transactions.

Comparing Cashback, Points, and Perks

Understanding structural differences keeps expectations aligned with spending patterns.

| Feature | Freedom Cards | Sapphire Series | Airline & Business |

| Reward Type | Cash deposited or statement credit | Flexible Ultimate Rewards® points | Co-branded miles or points |

| Redemption Boost | None | Up to 50 % more via portal (Reserve) | Transfer to partner airlines |

| Travel Extras | Limited | Lounge access, travel credits, insurance | Free checked bags, boarding priority |

| Annual Fees | $0 | $95–$550 | $0–$150 (personal), $95 (business) |

| Ideal User | Cashback seeker | Frequent global traveler | Brand-loyal flyer or entrepreneur |

Selecting the Right Card for Your Spending Profile

Picking a winner becomes straightforward once you identify primary purchase categories.

- Focus on flat-rate cashback? Freedom Unlimited fits you if simplicity outranks seasonal optimization.

- Comfortable activating quarterly categories? Freedom Flex rewards proactive planners with 5 % cycles.

- Moderate travel frequency? Sapphire Preferred balances price and perks, delivering high redemption value.

- High annual travel budget? Sapphire Reserve unlocks lounges, statement credits, and 50 % point boosts, justifying its premium fee.

- Credit beginner? Freedom Rise builds history without annual costs, provided balances stay low.

- United devotee? United Explorer enhances every flight through baggage savings and mile multipliers.

Application Roadmap

Preparation boosts approval odds under Chase’s “5/24 Rule,” which typically declines applicants opening five or more personal cards across issuers in the past 24 months.

- Check Credit Score: Aim for 670 + to qualify for most products.

- Gather Documents: Have Social Security number, stable income proof, and housing details ready.

- Apply Online: Navigate to the Chase card page, select “Apply Now,” and submit accurate information.

- Review Terms: Confirm APR ranges, introductory offers, and fee structures.

- Await Decision: Instant approvals happen frequently; manual reviews may take several days.

- Activate and Optimize: Upon arrival, enroll in autopay, set spending alerts, and track category activations where required.

Alternate application methods include phone support at 1-800-935-9935 or visiting a branch with identification and income documentation.

Interest Rates, Fees, and Variable Costs

Understanding ongoing charges prevents unpleasant surprises.

- Introductory APR: Many consumer cards offer 0 % for 15 months on purchases and balance transfers.

- Standard APR Range: 18 %–29 % variable, tied to creditworthiness and market rates.

- Balance Transfer Fee: 3 %–5 % of transferred amount.

- Late Payment Penalties: Up to $40 and potential penalty APR.

- Authorized User Fee: $75 for Sapphire Reserve; most other cards waive this cost.

Disclaimer: All data accurate at publication. Chase may modify offers without notice.

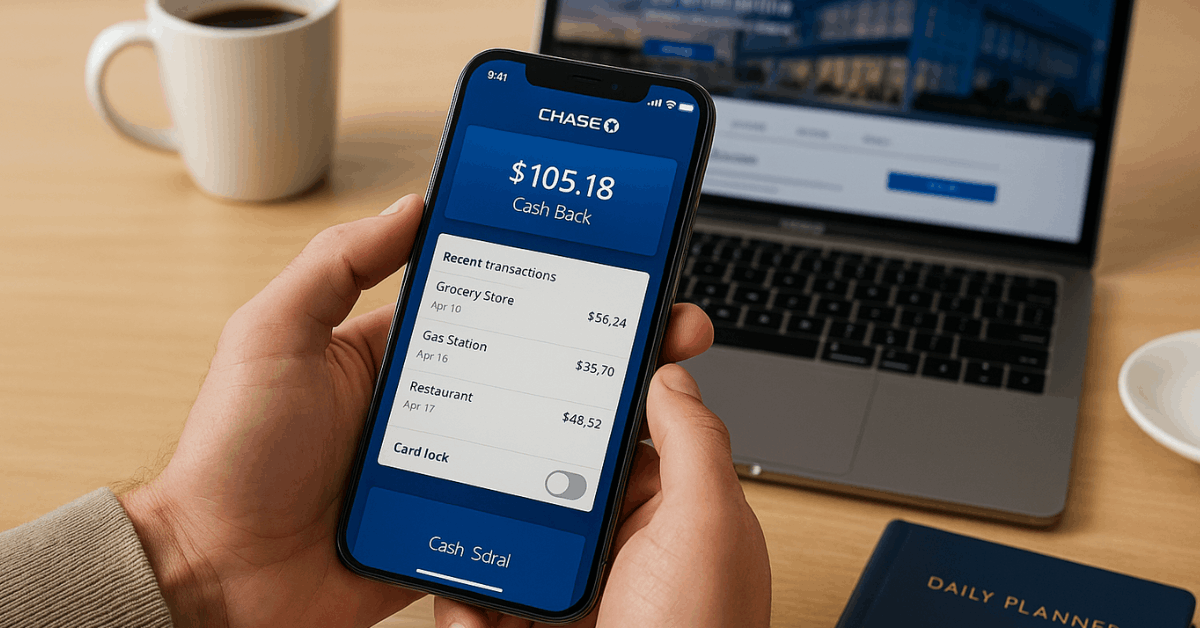

Managing Your Account Efficiently

Chase Mobile® and the online portal let you track balances, redeem rewards, and set custom alerts. Enabling push notifications improves fraud detection worldwide, while recurring autopay guards against late fees.

Key digital features:

- Real-time transaction monitoring

- One-tap statement payments

- Credit score updates powered by Chase Credit Journey®

- Secure card lock/unlock when traveling or if misplaced

Chase vs Capital One

Identifying unique advantages helps finalize an issuer decision.

| Category | Chase | Capital One |

| Travel Portal | Ultimate Rewards® with up to 50 % boost | Capital One Travel with price prediction |

| Lounge Network | Priority Pass™ (Reserve) | Capital One Lounge (Venture X®) |

| Transfer Partners | 14 + airlines and hotels worldwide | 15 + airlines and hotels worldwide |

| Cashback Strength | Freedom series | Quicksilver, Savor |

Both ecosystems remain competitive; choose based on preferred airline partners, lounge geography, and portal experience.

Frequently Asked Questions

You might ask these questions along the way:

- How many Chase cards can you hold?

Approval typically halts after five new personal cards across issuers within 24 months. - Can points be pooled across cards?

Yes, Ultimate Rewards® points combine freely, enhancing redemption flexibility. - Which card works best for Amazon spending?

Prime members receive 5% back at Amazon and Whole Foods with Prime Visa. - Where can accounts be managed?

Use the Chase Mobile® app or www.chase.com for full control.

Contact Information

Use this information to reach out for assistance:

- General Consumer Support: 1-800-432-3117

- International Assistance: 1-302-594-8200 (collect calls accepted)

- Small Business Cards: 1-888-269-8690

- Website: www.chase.com

- Mailing Address: P.O. Box 15298, Wilmington, DE 19850, USA

Conclusion

Selecting a Chase card aligned to your spending not only enriches day-to-day purchases but also unlocks travel benefits and measurable cashback.

Compare sign-up bonuses, ongoing reward structures, and fee trade-offs carefully, then apply with confidence knowing you have matched personal goals to the strongest product available today.